Loan Amount: $10,000 to $250,000.

Interest Rates: Variable rates based on prime rate + margin.

Duration: Revolving credit, usually renewed annually.

Fees: Annual, maintenance, transaction fees.

Finance tailored to your needs: Choose the best with Scale Capital.

5 Steps to Scaling Your Business

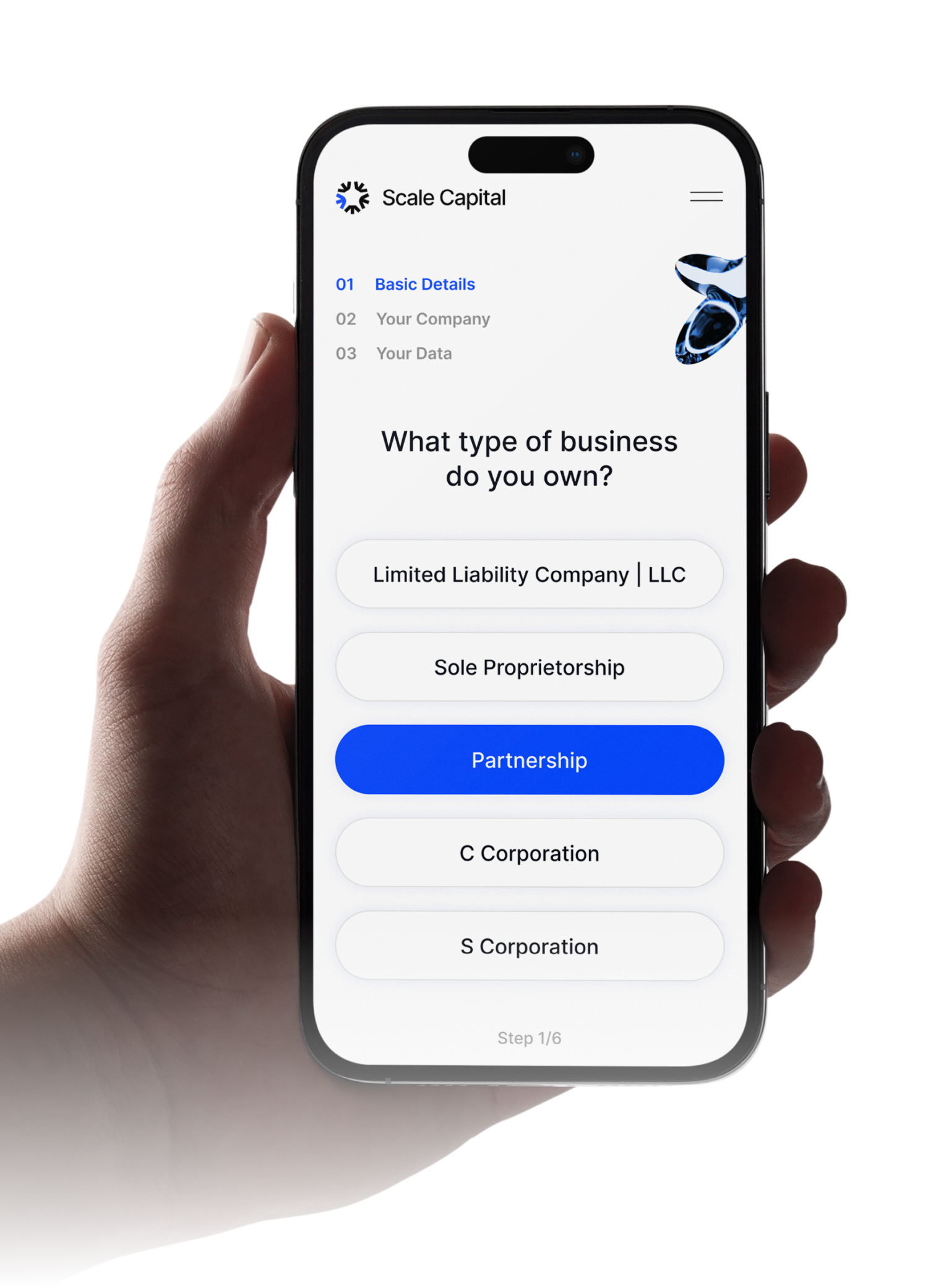

Fill out the application It’s as simple as possible, taking only a few minutes of your time.

Get a free consultation We’ll tailor the terms to suit your request.

Await funding Funds will be credited within a day of signing the agreement.

Automatic Loan Repayment We streamline loan repayment with automated ACH withdrawals, ensuring seamless payments on your preferred schedule — daily, weekly, or monthly. Easily stay on top of your loan obligations.

Renew for Added Capital Manage your finances responsibly and unlock access to more capital by paying off your loan early. Enjoy efficient and flexible business financing solutions.